If you are looking for the Twitter Elon Musk court filing, you can read the unedited court document. We had a hard time finding it. It’s 62 pages long but very interesting, funny, and well worth the read. You will learn a lot about business and law from it, even if you are already a lawyer.

This article will break down the key points in the court document, and focus on the screenshots that are included. If you enjoy the article, consider sharing it on social media or sending it to people. We want people to learn about court filings, and how to do them properly.

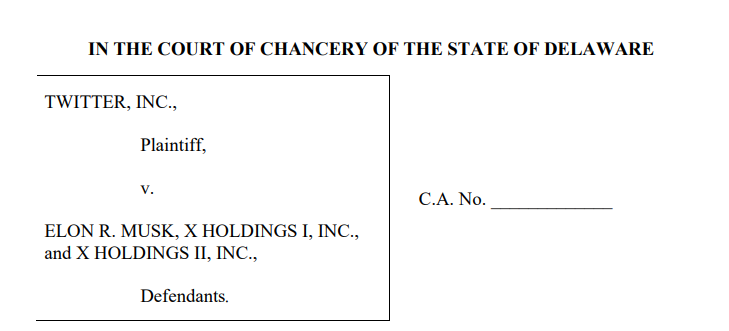

The lawsuit was filed in the State of Delaware by Twitter, against three Defendants. Elon Musk, and two companies that he set up in Delaware in order to purchase Twitter.

Twitter’s lawsuit against Musk could very well be the civil litigation trial of the year, with five law firms involved.

Twitter is represented by:

- WACHTELL, LIPTON, ROSEN & KATZ

- WILSON SONSINI GOODRICH & ROSATI, P.C

- POTTER ANDERSON & CORROON LLP

Elon Musk and his sub-companies are represented by:

- QUINN EMANUEL URQUHART & SULLIVAN, LLP

- SKADDEN, ARPS, SLATE, MEAGHER & FLOM L

The lawyers representing Twitter

As you can see above, Twitter is represented by a lot of different lawyers and law firms, including:

- Wachtell, Lipton, Rosen and Katz (New York)

- Wilson Sonsini Goodrich and Rosati (Deleware)

- Potter Anderson and Corroon LLP (Deleware)

This author has no experience in big law litigation, but it seems strange to need three different law firms to file a lawsuit. Presumably, the three law firms have different areas of expertise. I guess when 44 billion dollars is on the line, you want all the legal advice and help you can get. One of the law firms is in New York and the other two are in Deleware. You can check out the law firm website links to learn more about the three law firms.

You can see the video below that explains the likely outcome of the lawsuit. To sum up the video, “Legal Eagle” a famous lawyer on Youtube, thinks that either Musk will settle, or Twitter will win the lawsuit.

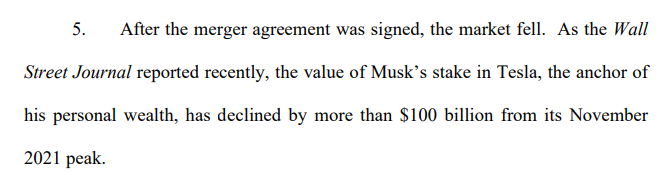

As you will see in the court filing that we shared, Twitter says that the reason why Musk is trying to pull out of the deal is because of the stock market downturn. Technology companies are worth a lot less now (because of inflation and high-interest rates.) According to the filing, Musk has recently lost around 100 billion dollars of net worth.

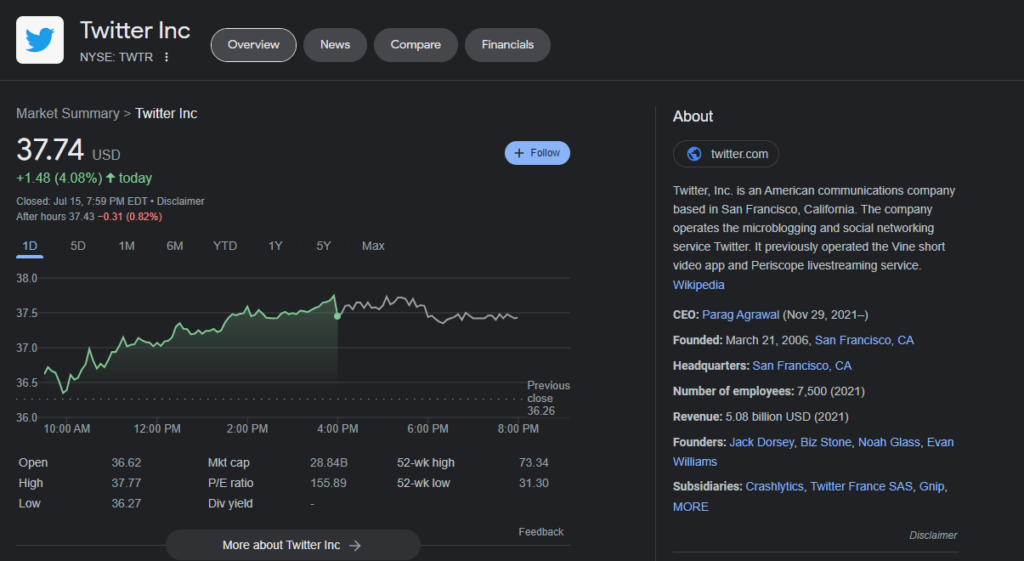

Elon Musk is likely either trying to pull out of the deal completely, or trying to get a better deal. Musk offered $44B for the company, and Twitter is now worth (has a market cap) of 28.84B. This would mean Musk’s net worth would decrease by 11.16B overnight if he stuck to his original deal. That’s a lot of money to lose.

How The Twitter Deal Was Structured

In April 2020, Musk agreed to put in $21 billion of his own money, while the remainder (around $25.5B) was to come from investment bank Morgan Stanley. But in order for him to receive such a massive loan (with an unknown interest rate), he had to put up $12.5 billion of Tesla stock as collateral. This meant that the higher the Tesla stock was, the fewer shares he would have to “lock up” as collateral. For Musk, the market downturn couldn’t have come at a worse time.

Instead of Tesla’s stock price going up, it dropped significantly after April 2022. The company’s shares sank significantly, from around $1000 USD to around $625 USD in the blink of an eye in market terms. With such a dramatic drop in value, this meant that Musk would have to put up 35 percent more Tesla shares as collateral to secure financing for the deal.

Though he remains the world’s richest man, it’s still quite possible that he might not have been able to swing it, as he has other costly ventures (Space X, The Boring Company, OpenAI, etc.) for which he might have already locked-up Telsa stock as collateral. And even Elon Musk doesn’t have an unlimited amount of Tesla stock.

Musk tries to get out of the Twitter deal

It’s likely that Musk’s objection about how many bots there are on Twitter won’t allow him to get out of the deal. He is likely trying to use litigation to get a better deal. Maybe he wants to buy the company for 35B instead of 44B. Paying some law firms a few million dollars to drag things out, and to try and save him 9B is well worth it.

Twitter has said that Musk wants to get out of the deal and pass on the market crash to the current Twitter shareholders. We believe Musk is still the largest shareholder, who owns around 9% of the company.

If you are wondering who the other two Defendants are, you can see the explanation below. This author doesn’t know enough about M&A law to explain why two companies would be needed to complete the merger agreement. They appear to offer the same function. It likely has something to do with tax law.

Twitter used a lot of Elon’s Tweets against him in the pleading. It seems that in the United States you can include evidence in a pleading. In British Columbia, Canada, you are not allowed to include evidence.

It’s very unusual to offer an insight into what you are thinking in business. Shortly after putting out these Tweets, Musk told Twitter he was thinking of making a hostile tender offer. Musk apparently communicated this in a letter to Twitter.

Basically, a tender offer is if Musk asked the shareholders to sell him the company, instead of speaking to management. It might be like the movie Other People’s Money, where the shareholders choose a new board of directors. Check out the movie if you have time, it’s fantastic.

According to Twitter, Musk closed the deal with no further conditions. He had the funding and had finished his due diligence (including looking into fake bots.)

Twitter financing structure

The below section is how Musk financed the $44 billion deal. Musk secured the money from the banks, using his stock ownership in Tesla as collateral. Musk would also provide money in cash.

Morgan Stanley was the bank willing to lend him $13 billion. The bank was to go out and find investors for the debt. The Tesla stock collateral put up by Musk was worth $62.5 billion.

Musk was to put in $21B of his own money, the market went down, and so did the value of the Tesla stock. That meant Musk would have to sell a significant amount of his shares in Telsa to buy Twitter. One could say that Musk would be moving a lot of his net worth from Telsa to Twitter. And it appears he does not want to do this.

There is little to no chance that Musk will be able to raise a post-due diligence request for more information as a reason to get out of a contract, even if he has two top law firms representing him.